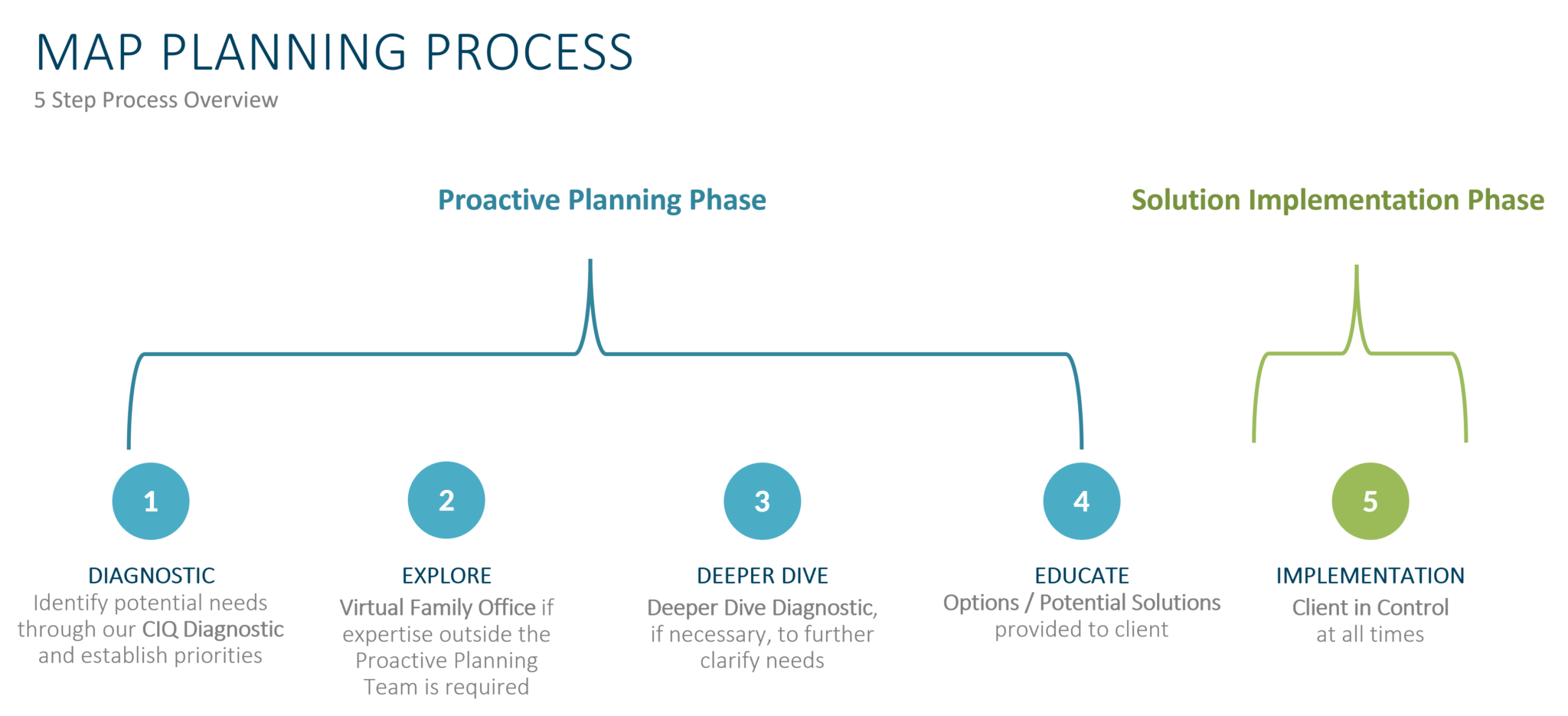

Proactive Planning Process

Virtual Family Office

"Virtual Family Office Experience" available at the click of a button.

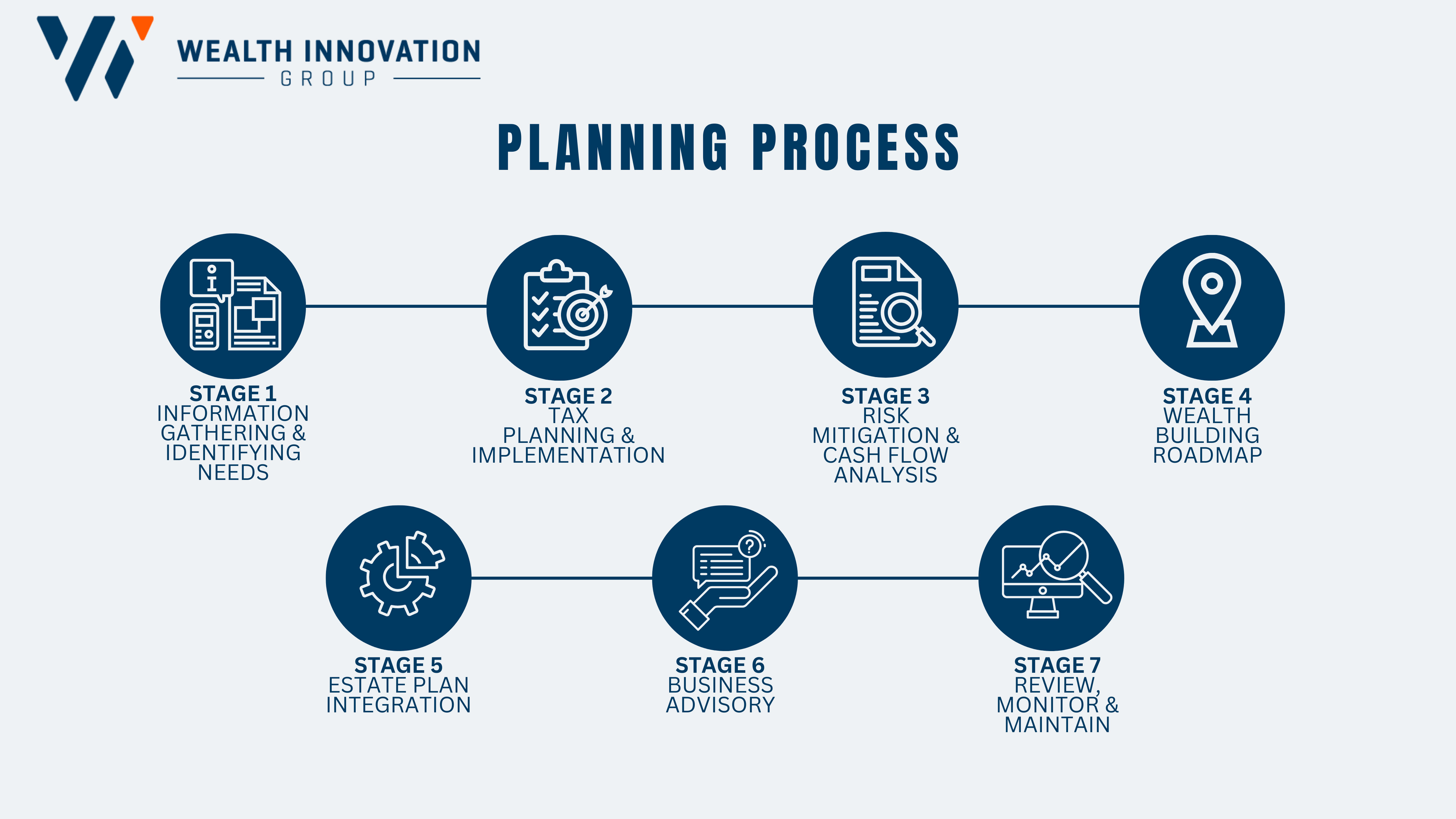

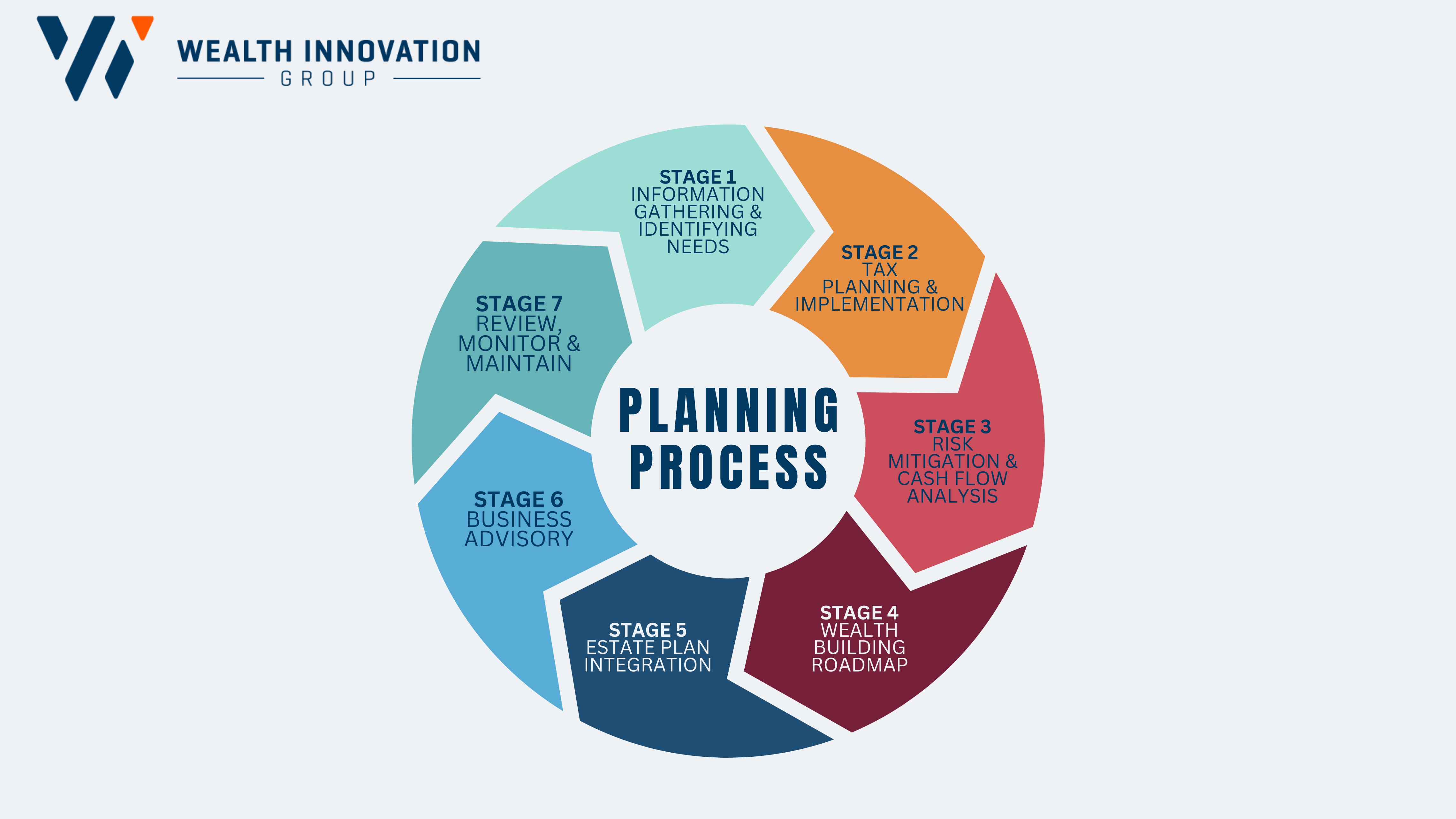

When it comes to your wealth plan, we begin with the end in mind.

Our in-depth planning process is designed to look at every critical aspect of your business, taxes, and retirement. By working together as a team and combining various experts and specialists, we can build you a truly comprehensive and holistic plan.

Stage 1 - Information Gathering & Identifying Needs- Assets

- Income

- Liabilities

- Most importantly your goals & objectives

Stage 2 - Tax Planning & Implementation

- Based on your goals, we will educate you on appropriate tax strategies

- Run projections and simulations for different options

- Help you decide on a course of action

- Implement applicable strategies

Stage 3 - Risk Mitigation & Cash Flow Analysis

- Help you determine which risks could significantly impact you or your business

- Review Risk Reduction Strategies with you

- Execute your Risk Mitigation plan in the most cost-effective manner possible

Stage 4 - Wealth Building Roadmap

- Discover if you are on track to meet your most important long-term financial objectives

- Assess your current strategy and measure if your current investments are in line with your financial goals and plan

- Evaluate if your assets are properly diversified

- Make adjustments to ensure savings and investments are in line with long term goals. Implement both growth and principal protection measures

Stage 5 - Estate Plan Integration

- Review your current estate plan and your legacy goals

- Educate you on estate planning options to minimize estate taxes or expenses and integrate your estate plan with other financial planning, retirement and legacy goals

- Work with our estate planning specialists to implement your estate plan from A to Z

Stage 6 - Business Advisory

- Uncover your biggest business challenges

- Create a business exit plan or improve upon your current plan

- Maximize business value and growth with company leadership/culture training, employee retention, cost reduction, automation, CFO services, and more

Stage 7 - Review, Monitor and Maintain

- Connect your accounts to our planning software for continual monitoring

- Establish a cadence for reviews and updates

- Make adjustments to your plan as you continue to go through life changes: tax situation, income needs, goals, liquidation events, health status, etc.

Everything you need to plan for your business, taxes, wealth, legal, and risk mitigation.